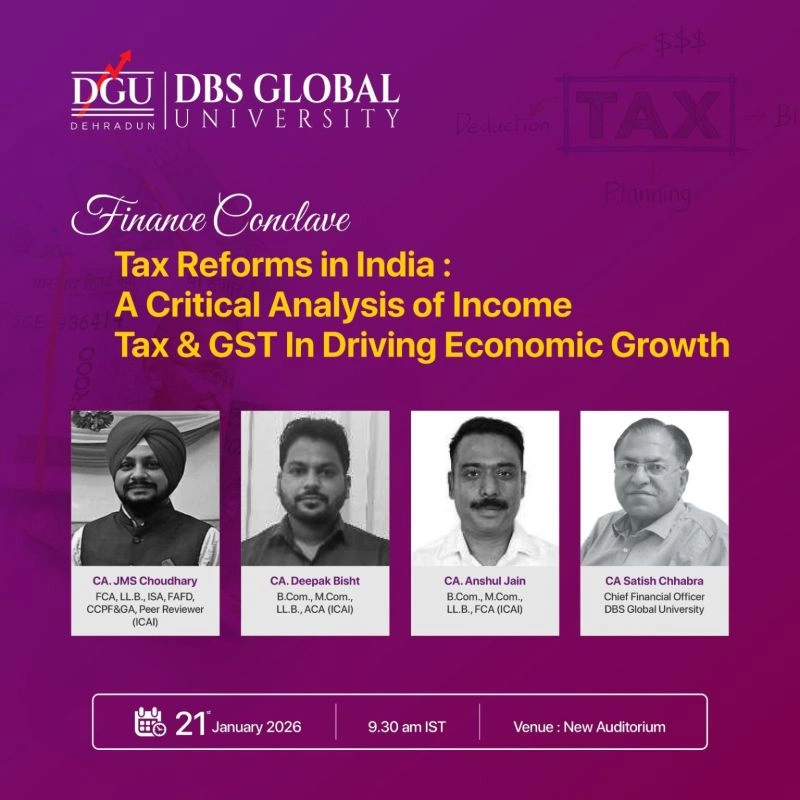

Understanding finance plays a central role in shaping economies, business decisions, and national progress. With this vision, we hosted a Finance Conclave on Shaping India’s Economic Future Through Tax Reforms, focusing on Tax Reforms in India: A Critical Analysis of Income Tax and GST in Driving Economic Growth.

The conclave brought together eminent speakers CA JMS Choudhary, CA Deepak Bisht, CA Anshul Jain, and CA Satish Chhabra, who shared in-depth insights on regulatory reforms, policy evolution, and their real impact on India’s economic growth. Through practical examples and real-world cases, the speakers unpacked how income tax and GST reforms influence businesses, governance, and long-term economic stability.

The session enabled students and faculty to gain a clearer understanding of modern taxation frameworks and their role in nation-building. Participants developed a stronger awareness of compliance, policy intent, and the practical challenges faced by professionals in the field. The conclave also helped bridge the gap between classroom learning and industry realities, encouraging critical thinking around financial strategy, governance, and economic decision-making.

The event concluded with active interaction and thoughtful discussions, leaving participants better equipped to interpret tax policies and their broader impact on India’s economic future.